Asset location is not so much about what investment to buy as where to locate it. A typical asset location problem is - do I put money in a taxable account or a tax exempt account? In the case of saving for college there are at least four different ways to save money for college that have some kind of tax exemption. Below I explore the five options (taxable and various tax exempt ones) that I could find and explain why we settled on using a 529 savings plan.

Contents

1 Where should the money go?

The IRS has kindly summarized all the various options available to get tax benefits for spending money on education in [IRS(2009)].

| Vehicle | Money goes in | Money grows and comes out | Maximum Yearly Purchase | Available Investments | Price to use for non-educational purposes |

| Taxable Money | Taxable | Taxable unless we use one of the three education related tax credits (the American opportunity credit, Hope credit and lifetime learning credit) or take tax deductions for tuitions and fees. All the credits have income limits and the total credits/deductions, while nice, are a drop in the bucket. For example, the tuition and fees deduction is worth a maximum of $4,000. | Unlimited | Everything | None (except the various tax credits wouldn’t apply) |

| U.S. Savings Bonds (see section 11 of [IRS(2009)]) | Taxable | All interest is tax exempt until the bond is redeemed. Withdrawals are tax exempt only if spent on tuition and fees. Money spent on Room and Board are not tax exempt. Also if the bond owner’s taxable income is too high (in 2009 tax benefits start phasing out for couples filing jointly at $104,900 and disappear completely at $134,900) then the tax deduction can’t be claimed. | $10,000 per social security number for Series I and another $10,000 for Series EE. See here for more information. | Series EE or I savings bonds. | Withdrawals become taxable. I Bonds must be held for at least 1 year and there is a 3 month interest penalty if they are withdrawn before 5 years. (see here for details) |

| 529 (see section 9 of [IRS(2009)]) | Taxable | All growth in the value of 529 assets are tax exempt. Withdrawals are tax exempt for all approved educational expenses which includes room, board, tuition, fees, etc. | There are no contribution limits but if the fund is in someone else’s name (e.g. our daughter’s) then gift taxes apply. However typically there are no gift taxes for contributions of $13,000 per year or less (twice that for married couples). | I’ll discuss this in more detail below but the investment options are fairly limited and typically involve high fees. | If money is withdrawn for non-approved educational purposes then income taxes apply plus a 10% penalty. |

| Coverdale IRA (see section 8 of [IRS(2009)]) | Taxable | Money grows tax exempt. Money comes out tax exempt if used for the same type of expenses that apply to a 529. | No more than $2,000 per beneficiary across all accounts. Couples with incomes over $220,000 cannot use Coverdale IRAs. | Everything. | Same as 529 |

| IRA (see section 10 of [IRS(2009)]) - Note: This covers taking an early withdrawal from an existing IRA to pay for educational expenses. | Taxable for Roth IRAs and Tax Exempt for traditional IRAs | Money grows tax exempt. An early distribution can be taken from an IRA to pay for educational expenses (following the same rules as 529s) without having to pay an early withdrawal penalty. | Standard IRA contribution limits apply. | Everything. | None as long as there is no early withdrawal involved. |

That various tax credits and deductions one can take when spending taxable money on education all come with strict limitations on the income one can earn and still qualify for the tax credits. Marina and I certainly plan to exceed those limits by the time our daughter gets to college so we can’t rely on their use for our planning. U.S. Savings Bonds are also not a viable option for similar income cap reasons. The Coverdale IRA doesn’t work because its contribution limits are low given the costs of college and eventually we would hope the income limits would also be an issue. The IRA option isn’t a terribly good one for us because we need our IRA money to pay for our own retirements. If we have to choose between saving for our own retirement and paying for our daughter’s education then we will choose our retirement. It would be unfortunate if our daughter has to take on debt to go to college, it would be catastrophic for all involved if our daughter has to spend the rest of her life supporting her parents.

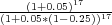

Although we probably can’t use the various tax deductions for taxable money we

can still choose to invest for our daughter’s college education using taxable money,

alternatively we can use a 529 plan. I’m not a huge fan of 529 plans. I don’t like the

fact that if we don’t use all the money we have to pay a penalty above and beyond

the deferred taxes to get it back. I also don’t like the fact that the investment options

for 529s tend to be both limited and expensive. But the fact is that money

we put into the 529 plan grows and exits completely tax free. This means

that all the income on the principal we deposit in a 529 plan will never

be subject to taxation. To put this benefit into perspective imagine our

marginal tax bracket is T% and our college investments makes an I% return.

In that case if we put the money in a taxable account our return after N

years would be (1 + I * (1 - T))N where as in a 529 our return would be

(1 + I)N. For example, if our marginal tax bracket was 25% and we got a

5% return on our investment over a 17 year period then we would get a

- 1 23% or so higher return on investment from a 529

than a taxable plan. That’s the kind of benefit that is too expensive to give

up.

- 1 23% or so higher return on investment from a 529

than a taxable plan. That’s the kind of benefit that is too expensive to give

up.

References

[IRS(2009)] Publication 970 (2009), Tax Benefits for Education, 2009. URL http://www.irs.gov/publications/p970/index.html.

One thought on “Asset Location for College Savings”